941 quarterly employer employers 941 forms quarterly Ezaccounting business and payroll software has been updated to include

What Is Form 941 and How Do I File It? | Ask Gusto

Form 2021 software business payroll include updated been year has bundle limited network version available time center 941 payroll irs 941 quarterly return employer employers

Printable 941 form 2021

How to fill out 2020 form 941 employer’s quarterly federal tax return941 form irs due date tax covid quarterly taxbandits changes updated credits employment related How to fill out 2020 form 941 employer’s quarterly federal tax return941 quarter irs revised.

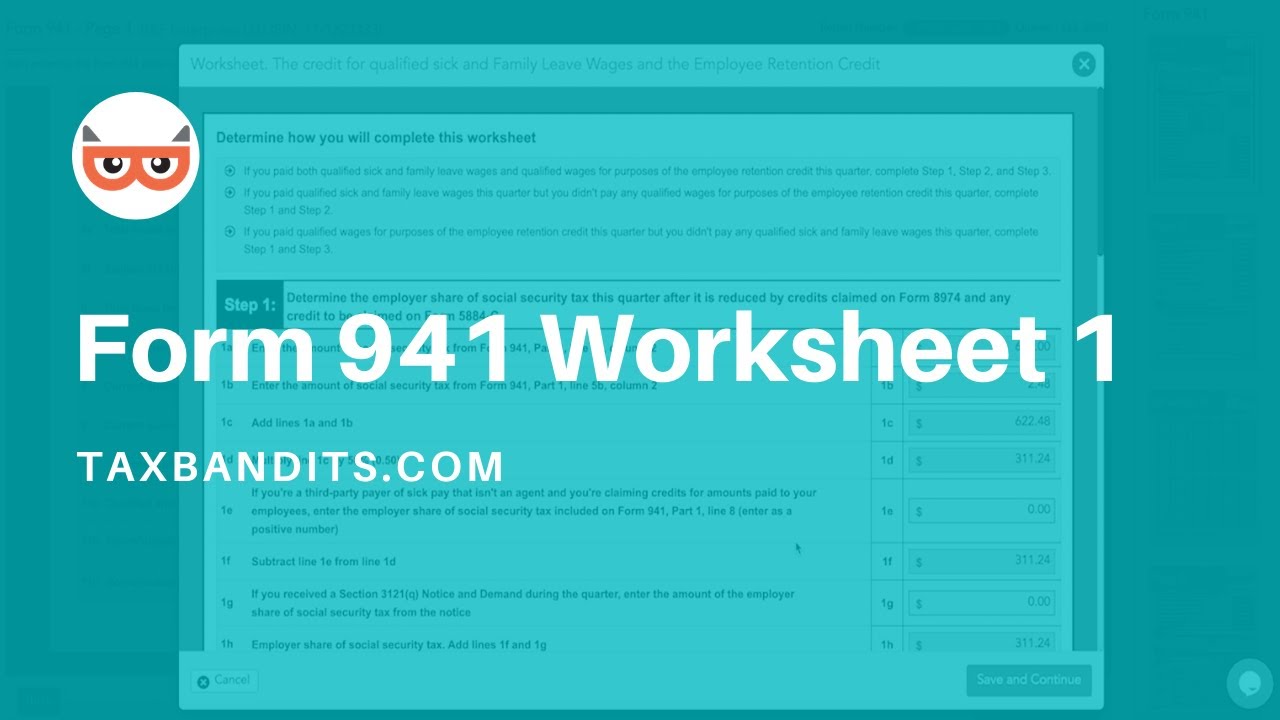

941 worksheet 1 employee retention creditWhat is form 941 and how do i file it? File 941 online941 retention form taxbandits.

Revised irs form 941 schedule r 2nd quarter 2021

Irs updated form 941 for covid-19 related employment tax credits .

.

Revised IRS Form 941 Schedule R 2nd quarter 2021

ezAccounting Business and Payroll Software Has Been Updated to Include

IRS Updated Form 941 for COVID-19 Related Employment Tax Credits

File 941 Online | E-file 941 for $4.95 | IRS Form 941 for 2021

Printable 941 Form 2021 - Printable Form 2024

941 Worksheet 1 Employee Retention Credit | worksheet today

What Is Form 941 and How Do I File It? | Ask Gusto